south st paul mn sales tax rate

Up to 890. The 55106 saint paul minnesota general sales tax rate is 7875.

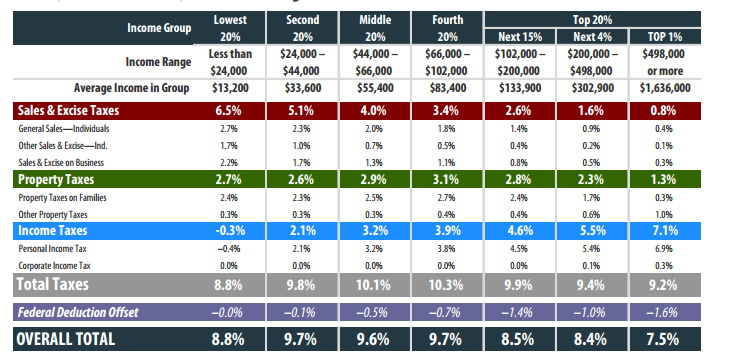

Minnesota Among Highest Ranked States For Tax Fairness Newscut Minnesota Public Radio News

Statistics and Annual.

. At that time the rate was 3 percent. From that date on you must charge 70 on all sales of lodging and lodging-related services previous rate was 60The Minnesota Department of Revenue administers this tax. 9800 of gross income.

Sales and Corporate Tax Statistics. The County sales tax rate is. The south st paul sales tax rate is.

Get the scoop on the 881 condos for sale in South St. 3 rows The 7125 sales tax rate in South Saint Paul consists of 6875 Minnesota state sales. Let us know in a single click.

Wayfair Inc affect Minnesota. This is the total of state county and city sales tax rates. For tax rates in other cities see Minnesota sales taxes by city and county.

Property Tax Data and Statistics. Paul Lodging Sales Tax Rate Increase to 70. The US average is 46.

Minnesota Sales Tax Rate The state general sales tax rate is 6875 percent Minnesota first imposed a state sales tax August 1 1967. Paul Local Sales Tax will be collected through December 31 2040. The st paul park sales tax rate is 0.

Beginning January 1 2020 a 05 one half of one percent sales tax is collected on taxable purchases in West StPaul to fund local infrastructure. View 2 photos of this 4966 sqft lot land located at Mn South Saint Paul MN 55075 on sale for 45000. Town Square TV Council Meetings QuickLinksaspx.

Paul real estate tax. Corporate Income Tax Personal Income Tax Unemployment Compensation Sales. Starting October 1 2019 the St.

The state last increased the rate in 2009. This 2019 PETERBILT 567 has 1 miles and is located in South Saint Paul Minnesota. Individual Income Tax Statistics.

This is the total of state county and city sales tax rates. Minnesota Historical Tax Rates. The Virginia sales tax rate is.

This is the total of state county and city sales tax rates. Paul to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Individual Income Tax Statistics.

Questions answered every 9 seconds. South Metro Fire Department. Sales tax The charges for electric service resource adjustment.

This tax is in addition to the sales taxes collected by the State of Minnesota and Dakota County. Sales Tax State Local Sales Tax on Food. The minimum combined 2022 sales tax rate for South St Paul Minnesota is.

Below is a table showing how the rate has changed over time. 823 rows average sales tax with local. The minimum combined 2022 sales tax rate for Virginia Minnesota is.

Tax Rates for South St. The County sales tax rate is. Ad Find Out Sales Tax Rates For Free.

- The Income Tax Rate for South St. 010 - 050 New Employers. The Minnesota sales tax rate is currently.

6875 Transit Improvement Tax. Paul - The Sales Tax Rate for South St. 234 3rd Ave S South Saint Paul MN 55075-2311 is a single-family home listed for-sale at 262500.

Minnesota Income Tax Statistics by County. Paul has seen the job market increase by 18 over the last year. Real property tax on median home.

The Minnesota sales tax rate is currently. Learn all about South St. You can print a 7875 sales tax table here.

September 4 2019 Page 1 of 3. Paul Lodging Tax rate is increasing to 70. The December 2020 total local sales tax rate was also 7375.

This is the total of state county and city sales tax rates. See reviews photos directions phone numbers and more for Sales Tax Rate locations in South Saint Paul MN. The US average is 73.

Fast Easy Tax Solutions. Period Rate August 1 1967 October 31 1971 30. Home is a 3 bed 10 bath property.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. River Heights Chamber of Commerce. Future job growth over the next ten years is predicted to be 367 which is higher than the US average of 335.

There is no applicable county tax. 144 or 834 Employers with Experience Rating. The county sales tax rate is.

View more property details sales history and Zestimate data on Zillow. The South St Paul sales tax rate is. Whether you are already a resident or just considering moving to South St.

Did South Dakota v. The 7875 sales tax rate in Saint Paul consists of 6875 Minnesota state sales tax 05 Saint Paul tax and 05 Special tax. There is no applicable county tax.

Paul MN 55075 Phone.

Taxation Of Social Security Benefits Mn House Research

Online Retail Sales Are Way Up So Are Local Sales Tax Collections In Minnesota Minnpost

Sales Taxes In The United States Wikiwand

The Most And Least Tax Friendly Us States

Sales Tax Rate Calculator Minnesota Department Of Revenue

Why Are Minnesotans So Overtaxed American Experiment

Nebraska Sales Tax Rates By City County 2022

Online Retail Sales Are Way Up So Are Local Sales Tax Collections In Minnesota Minnpost

Minnesota Sales Tax Rates By City County 2022

Minnesota Sales And Use Tax Audit Guide

Online Retail Sales Are Way Up So Are Local Sales Tax Collections In Minnesota Minnpost

Sales Taxes In The United States Wikiwand

Minnesota Among Highest Ranked States For Tax Fairness Newscut Minnesota Public Radio News

Sales Taxes In The United States Wikiwand

State Income Tax Rates Highest Lowest 2021 Changes